Why SimplifyX Could Become the Most Important AI Company You Haven’t Heard Of (Yet)

Why regulated industries can’t tiptoe into AI and why I’m excited about SimplifyX

Reinvention at an Unprecedented Scale

Business leaders love to talk about transformation. Every five years a new buzzword rolls through: digital transformation, cloud migration, agile adoption. Most of these “transformations” were partial — a department here, a process there.

This moment is different.

For the first time in business history, reinvention isn’t about tweaking. It’s total.

Every workflow is under the microscope for automation, elimination, or reinvention.

Every role is being redefined — from task executors to exception managers and decision enablers.

Every process must be re-architected — from static SOPs to dynamic, AI-driven flows.

Every business model is shifting — from selling seats and hours to outcomes and SLAs.

Every distribution channel is in play — no longer linear but multi-layered ecosystems.

And ultimately, the company itself must reinvent — ground-up and top-down.

This is not optional. It’s not marketing spin. It’s the competitive reality of an AI-first world.

The winners will be those who embrace reinvention at this scale. The laggards will be buried by their own complexity.

Why Regulated Industries Are Stuck

If you’re in banking, airlines, or credit unions, you already know this truth: you want reinvention, but your systems, regulations, and risk profile keep you shackled.

The challenge isn’t ambition. It’s architecture. Reinvention in regulated industries requires solving for a trifecta that most technology vendors don’t even acknowledge:

Regulated-industry awareness

Compliance, audit, security, access controls, data residency, distribution models — these aren’t add-ons. They’re non-negotiable.Future protection

Reinvention can’t mean ripping and rebuilding every time a new model emerges. You need durability and portability.AI flexibility

You must be able to adopt the best AI agents today and swap them tomorrow. Vendor lock-in is unacceptable when the pace of innovation is measured in months, not years.

Fail any one of these three, and reinvention collapses.

The New Definition of Omni-Channel

Historically, “omni-channel” meant you had a call center, a website, maybe a chatbot — and they all sort of worked together.

That definition is dead.

Today’s omni-channel means multi-agent continuity across multiple modalities. A seamless ability to shift between voice, chat, RPA, and human agents — without losing context, compliance, or security.

In banking, a customer might begin with an onboarding bot, get routed through an RPA agent handling document checks, and then escalate to a branch rep — all while data and context flow securely.

In airlines, a traveler might search for flights via a voice bot, pivot to a text agent for baggage policies, and return to the voice bot to rebook — without re-explaining the issue.

In credit unions, a member might interact via a call center agent, move to a web portal, and later access benefits through a partner-provided platform.

This is the new omni-channel: not about channels, but about continuity across agents.

Try to reinvent omni-channel with isolated pilots, and you’ll fail.

Distribution Model Complexity

And then there’s the elephant in the room: distribution.

Unlike consumer tech companies, regulated industries don’t fit neatly into B2B or B2C. They operate in layered ecosystems:

B2B2C: A bank serving employers who then serve employees. A credit union serving plan sponsors who then serve members.

B2B2B2C: An airline selling through travel agencies, alliances, and corporate partners before reaching the passenger.

Hybrid paths: Some customers are direct, others come through intermediaries — sometimes both in the same transaction.

Within these webs are multiple actors: internal employees, independent agents, brokers, plan sponsors, partner reps, and end customers.

Each of them needs a different type of agent. Each requires unique permissions, security, and workflows. And all of them expect personalization.

This makes distribution not just a sales problem but a reinvention bottleneck. Flexibility is mandatory. Unification is essential.

And again, tinkering with single-agent pilots is a non-starter.

The Missing Middle: Enterprise AI Bus (EAB)

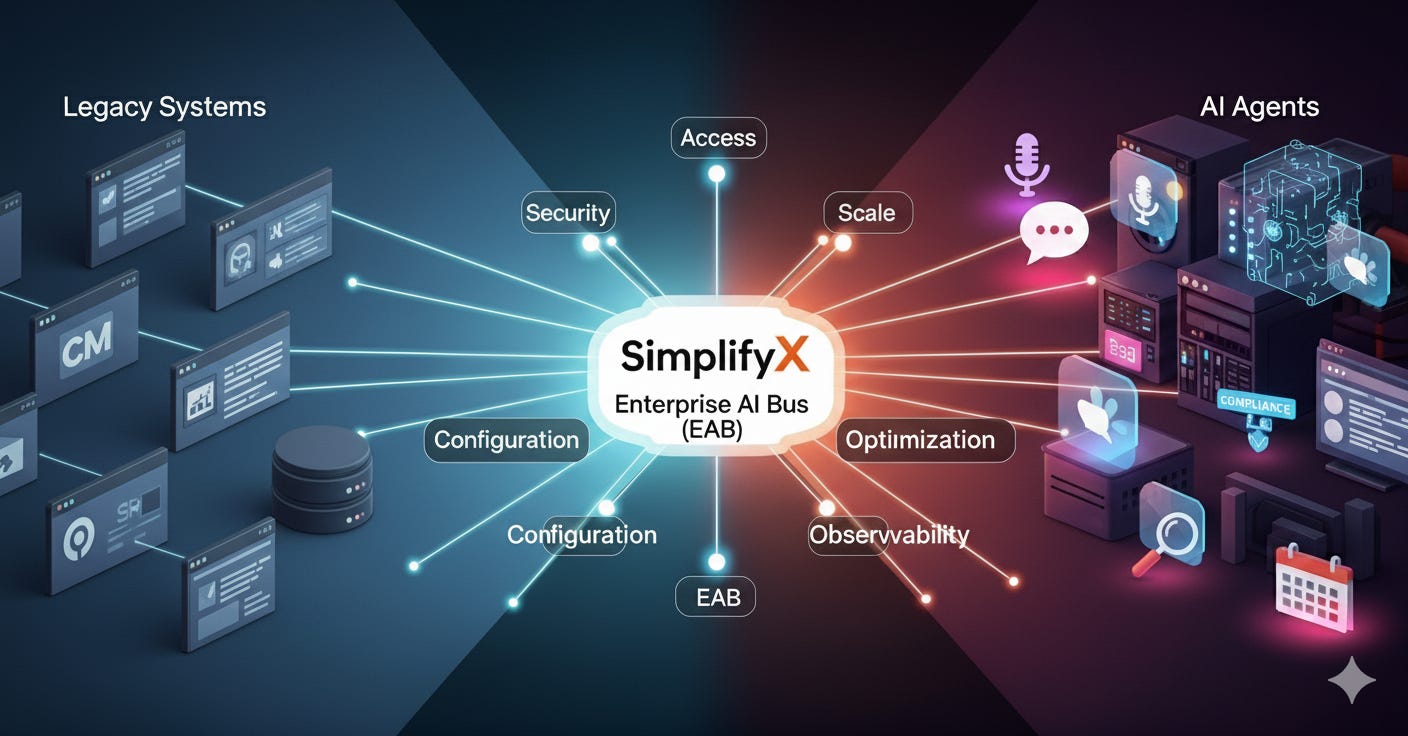

So here’s the reality: on one side you have legacy systems — decades of databases, mainframes, and enterprise software. On the other, you have a new generation of AI agents — voice, chat, RPA, compliance, scheduling, personalization.

What’s missing is the middle layer.

That missing middle is the Enterprise AI Bus (EAB).

The EAB acts as the unifying control plane between the old and the new. It delivers:

Access control – fine-grained permissions, policy enforcement, least privilege.

Security – compliance, auditability, encryption, safe handling of sensitive data.

Scale – enterprise-grade throughput across multiple workflows and roles.

Configuration – central business logic and rules that stay portable across vendors.

Personalization – tailored experiences for employees, partners, and customers.

Orchestration – seamless coordination across multiple agents, channels, and distribution layers.

Without an EAB, every attempt at reinvention collapses under its own complexity.

With it, enterprises finally have the foundation to reinvent boldly, securely, and at scale.

Why SimplifyX Matters

This is why I’m excited about SimplifyX.

SimplifyX isn’t trying to build the “smartest agent.” It’s building the Enterprise AI Bus (EAB).

It solves the trifecta: regulated-industry awareness, future protection, and AI flexibility.

It addresses the new omni-channel reality — continuity across agents, not just channels.

It embraces the distribution model complexity — supporting ecosystems that are B2B, B2B2C, B2B2B2C, and everything in between.

SimplifyX is building the system that sits in the middle. The platform that makes regulated-industry reinvention not just possible, but practical.

Reinvention in Banking, Airlines, and Credit Unions

Let’s go back to the three industries where this matters most:

Banking: Reinvention means an onboarding process where an RPA agent, a fraud-detection engine, and a human banker can work in tandem under a single logic layer. The EAB ensures compliance, security, and continuity.

Airlines: Reinvention means a traveler can move seamlessly between voice, text, and kiosk agents while dealing with bookings, baggage, and rebooking. The EAB ensures context persists and compliance holds.

Credit Unions: Reinvention means members can interact through call centers, digital portals, and plan sponsors with different access rights, while all flows unify through the same orchestration layer.

These are not “nice-to-haves.” They’re survival requirements.

The Visionary Close

Here’s the provocation:

Pilots are the new graveyards of ambition.

Enterprises that keep “testing” isolated AI agents will stall. Regulated industries don’t have the luxury of incremental change. Their complexity demands reinvention — total reinvention.

And that reinvention cannot happen without a unifying control layer.

The Enterprise AI Bus (EAB) is that layer.

SimplifyX is building it.

And that’s why I believe SimplifyX isn’t just another AI startup. It’s the company giving regulated industries the only realistic way to reinvent — boldly, securely, and at scale.

PS: I am a GTM advisor for SimplifyX’s parent organization

A great article and a new way of looking at AI + legacy systems. You’re not fighting for a pie in the market but completely creating & owing the EAB market. Best wishes sir!